What is TenkoFX?

TenkoFX is an online brokerage that specializes in Forex trading. The brokerage also offers trading accounts most suitable for CFDs, STP, ECN, and cryptocurrencies to its clients.

TenkoFX is well-known for its competitive spreads, commission fees, and lightning-quick execution speeds. Its ECN trading model grants clients from around the world with access to the interbank market as well as with order execution with its market execution mode.

In addition, it has also grown in popularity for its trading tools and educational materials.

It has liquidity providers from some of the leading banks in the world including JPMorgan, Goldman Sachs, LMAX, Deutsche Bank AG, and Morgan Stanley, to name a few.

TenkoFX is also known for developing and investing in various projects aimed at bettering their services, tools, and trading opportunities for their clients.

In this review, we will take a brief look at some of the features and services that this online brokerage provides and see if it does hold up to its reputation or not. In addition, we will investigate into its background to see if the broker is a safe choice for traders.

TenkoFX: Services and Offerings

While TenkoFX offers the following services to clients residing in almost any part of the globe, it may not provide all the services given below. Clients residing in certain countries such as the United States may also not be able to gain access to its services due to legal restrictions.

• Trading Instruments

TenkoFX offers over 68 financial instruments with most of it being focused on its Forex and Cryptocurrencies listings. However, it also has a few offerings in CFDs, Indices, and Metals.

• Account Types

TenkoFX offers three types of trading accounts – the STP Account, the ECN Account, and the Crypto Account.

All three of its accounts allow its clients to trade with spreads starting from 0 pips with a $1 commission per trade lot. All account types have a maximum leverage level of 1:500 and can be opened with a minimum deposit of only $10. The account types also feature market execution with possible slippage and minimal re-quotes.

The STP Account allows clients to trade in Forex and Metals with no trading restrictions. The minimum trading volume is 0.01 lots and has a swap-free option.

The ECN Account allows clients to trade in Forex, Metals, and CFDs with no trading restrictions. The minimum trading volume is 0.01 lots and has a swap-free option. It also offers 4 units of a base currency for 1 lot ($100,000), which can be lowered to just $1 if the trading volume is increased.

The Crypto Account is mainly focused on clients who wish to trade mainly in Cryptocurrencies. With this account type, clients can trade with up to 29 Cryptocurrencies, including Bitcoin, Litecoin, Bitcoin Cash, Dash, and Ethereum. The Crypto Account features a 1:3 leverage level with a minimum trading volume of 0.01 lots.

Demo accounts are also available for free, which allows clients to test out the mentioned account types in a simulated, risk-free trading environment.

• Trading Platform

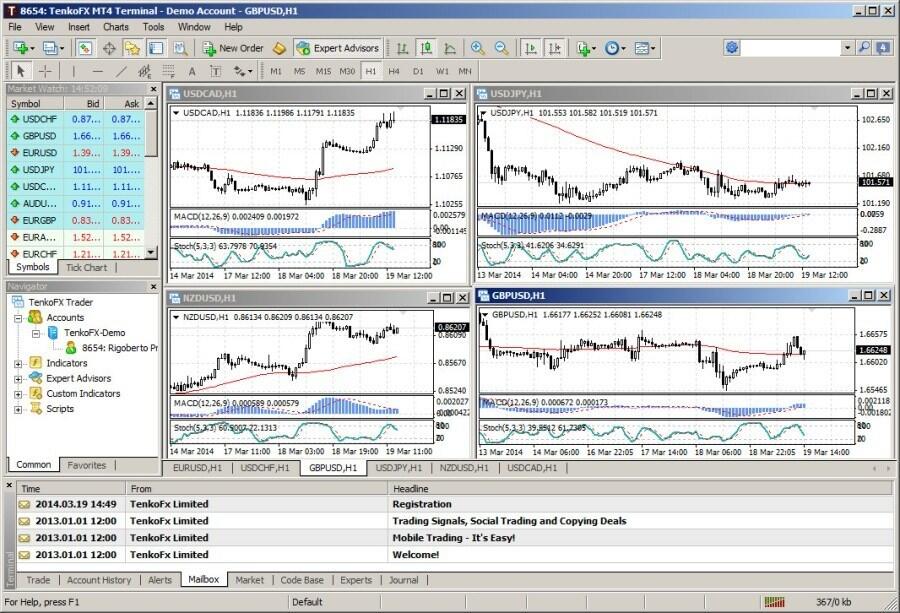

TenkoFX mainly incorporates the MetaTrader4 (MT4) trading platform by MetaQuotes. MT4 is one of the leading trading platforms in the industry, most notable for its easy-to-use interface, lightning-quick execution time, and flexible customizability. It features real-time market quotes as well as over 80 pre-installed technical indicators, charting tools, and automated trading options, to name a few.

• Payment Options

Payment options include credit/debit cards, bank wire transfers, and online payment services such as Neteller, Skrill, Fasapay, advcash, Perfect Money, and UnionPay. Deposits and withdrawals can also be done with cryptocurrency.

Withdrawals are usually processed within the same day, though it could take more if requests are done outside of business hours. Bank transfers usually take two to three business days to process, though some options can take a few seconds.

Most of the details is often subject to change and can be found in TenkoFX’s official website.

It must be noted that some of the payment options listed above may only apply to specific countries and some service providers may charge fees.

TenkoFX: Is it safe?

TenkoFX’s operations are regulated by the International Financial Services Commission (IFSC), which is situated in Belize. The IFSC is considered by most as an offshore regulatory body. This means that certain malpractices can still go unnoticed due to lax jurisdiction. Some of the more reputable regulatory entities it could have gone for include examples such as the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investment Commission (ASIC).

However, TenkoFX implements a series of highly effective security measures that removes most risks that pose a threat to their clients’ best interest.

TenkoFX: Conclusion

All in all, TenkoFX is a decent and relatively safe broker, providing its client base with a large variety of financial assets which is mostly seen with its Forex listing. Furthermore, it boasts highly competitive spreads and commission fees. Its trader’s academy and PAMM accounts are also a big plus for novice traders.

However, the biggest downside for TenkoFX is its regulation. The quality of this online brokerage could well be improved with a more well-known financial authority in order to guarantee safety over its clients’ funds. In addition to this, TenkoFX’s listings offered outside of the Forex market can be considered lacking when compared to other online brokers.

If none of the points above seem a problem to you, or if you are more inclined to trading in the Forex market above all else, TenkoFX can be an adequate place to start. However, it should be known that there are other better-regulated brokers with the same level of service quality that this broker provides.