What is Arum Capital?

Arum Capital is an online brokerage that mainly focuses on providing its clients with access to the Forex markets.

Arum Capital is most known for its competitive trading conditions. In addition, they have some of the largest liquidity providers including LMAX Exchange from the UK and Swissquote from Switzerland. These allow Arum Capital’s clients to have access to first-class liquidity, such as low spreads and quick execution speeds for favorable prices.

According to Arum Capital, 99.9% of orders carried out are executed in 5 milliseconds with no re-quotes.

In this review, we will take a brief look at some of the features and services that this online brokerage provides and see if it does hold up to its reputation or not. In addition, we will determine whether the broker is a safe choice for interested traders.

Arum Capital: Services and Offerings

While MTrading offers the following services to clients residing in almost any part of the globe, some offers may differ depending on the location of the client. Furthermore, clients residing in certain countries such as the United States, Japan, Canada, Germany, North Korea, Belgium, France, and other countries under the Financial Action Task Force may also not be able to gain full access to its services due to legal restrictions.

• Trading Instruments

Arum Capital offers a wide variety of financial instruments to its clients, including over 69 Forex pairs, and CFDs for over 11 Indices, 7 Metals, 3 Energy, and 5 Cryptocurrencies. However, some may find its non-Forex offerings less in variety compared to other online brokerages.

• Account Types

Arum Capital offers its clients two account types – the ECN Standard Account, and the ECN Classic Account. These account types can be chosen based on the client’s trading strategy.

The ECN Standard Account requires a minimum deposit of $500 and clients can trade with narrow spreads starting from 0 pips and with variable commission.

The ECN Classic Account requires a minimum deposit of $500 and clients can trade with spreads starting from 0.7 pips and with no commission.

Clients with a trading volume over 200 lots per month are eligible for its VIP benefits. These benefits include a personal manager, access to training and workshops, improved solutions for money transfers, free VPS, and much more. Other details can be found on Arum Capital’s official website.

Clients can also opt for a free demo account where both account types and its features mentioned above can be tested. The demo account allows clients to trade with $10,000 in virtual funds in a risk-free trading environment.

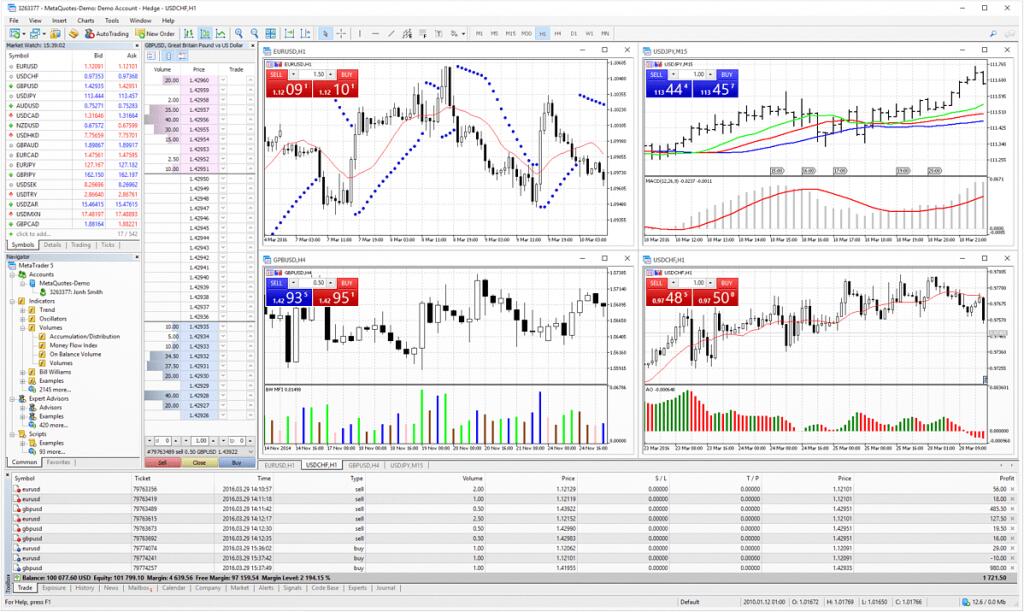

• Trading Platform

Arum Capital implements the use of the MetaTrader5 (MT5) trading platform by Metaquotes. MT5 is one of the leading trading platforms in the industry, most notable for its easy-to-use interface, lightning-quick execution time, and flexible customizability. It features real-time market quotes as well as over 80 pre-installed technical indicators, charting tools, and automated trading options, among its other features.

In addition, the MT5 trading platform supports one-click trading and comes with an in-built economic calendar to keep track of various economic events around the world in real time. The MT5 platform can also notify clients of price changes along with news from the MQL5 Community in the terminal.

The MT5 trading platform also boasts lightning-quick execution through its implementation of FIX-protocol, allowing client orders to be carried out within milliseconds.

MTrading’s trading platform is available in desktop, browser, and mobile versions.

• Payment Options

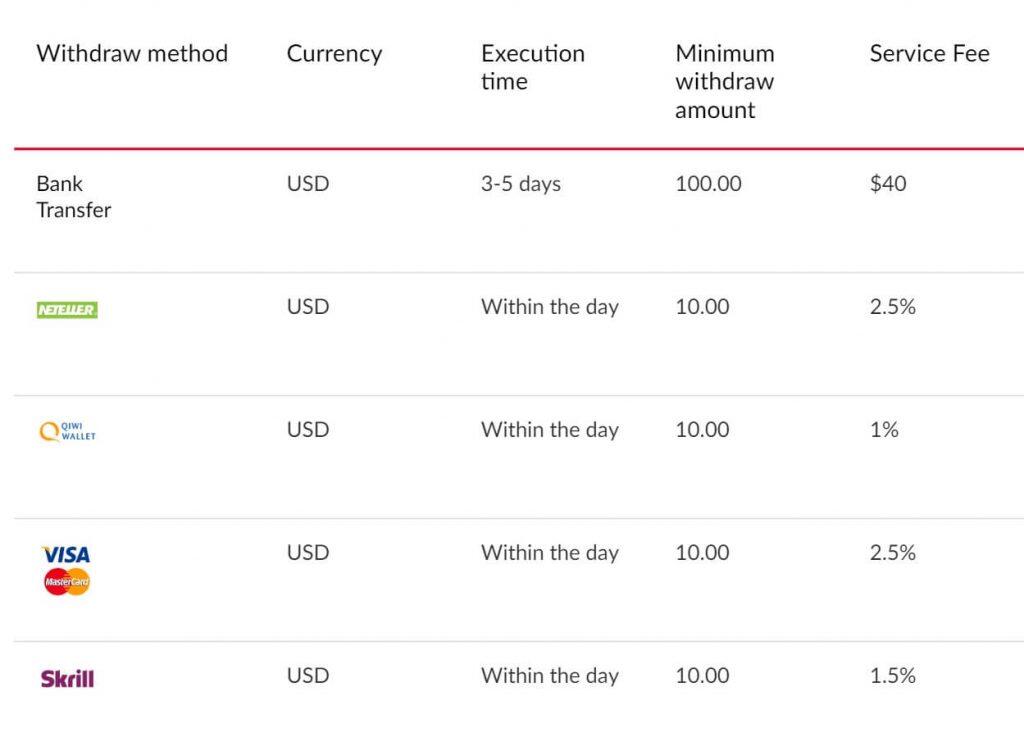

Payment options include credit/debit cards, bank wire transfers, and online payment services such as Neteller and Skrill. Deposits and withdrawals can also be done with cryptocurrency.

Withdrawals are usually processed within the same day, though it could take more if requests are done outside of business hours. Bank transfers usually take two to three business days to process, though some options can take a few seconds.

There are no fees for deposits; however, bank processing fees may apply depending on which service has been chosen. Online payment services may charge additional fees for deposits or withdrawals.

Most of the details is often subject to change and can be found in MTrading’s official website.

It must be noted that some of the payment options listed above may only apply to specific countries and some service providers may charge fees.

Arum Capital: Is it safe?

Arum Capital is a brand name which is owned and operated by its proprietor ArumPro Capital Ltd, located in Cyprus. ArumPro Capital Ltd is an investment firm regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe with the license no. 323/17.

This means that should any unforeseen events were to prevent Arum Capital from fulfilling necessary financial obligations, the broker would have to pay up to €20,000 from the Investment Compensation Fund (ICF). In addition, client funds are held in segregated accounts to prevent the broker from using it for internal purposes.

The European CySEC regulator also uses the STP license that makes it mandatory for the company licensed under it to transmit all client transactions to its liquidity providers.

All these together, it can be safe to say that Arum Capital is a regulated broker and is a secure choice for anyone who is interested.

Arum Capital: Conclusion

In conclusion, Arum Capital is a fairly decent broker that offers a great selection of Forex currency pairs that can be traded with competitive trading conditions. However, while its non-Forex listings are also adequate, they can be much sparse than other online brokers of the same caliber. Also, some may find its educational materials to be limited and some of its website’s market analysis to be outdated. Other than that though, Arum Capital’s offerings and services are sufficient enough and can be a good start for novice Forex traders.