Is Alpari Really a Trustworthy Brokerage?

Emerging from months of examining all facets of the brokerage, Alpari, the review team had turned in a pointed and well-informed evaluation of the firm’s capabilities. This had been done through an wholistic examination of Alpari’s services. The team had given great focus on the following aspects:

- The financial authorities that sanction all of Alpari’s trading activities

- The assets the firm gives its clients access to

- The types of live accounts the firm offers

- The trading platforms available through every trading account

- The leverages provided to traders for their transactions in certain markets

About Alpari

Like a lot of brokers, Alpari is headquartered in St. Vincent and the Grenadines. It was setup within the region back in 1998. Although it operates across a lot of countries, the firm is limited from conducting business within the United States, Canada, and Iran.

The image that online reviews paint about Alpari may be considered polarizing at best. It is true that the reliability for this brokerage is fine, but regulation status is still held in question as it actually lacks it. While this stands, Alpari may still be held viable because of its membership with a Hong Kong-based financial commission. It must be noted however that the firm does not take cues from the regulations of the region. Nevertheless, Alpari is self-regulated to ascertain the legitimacy of the firm.

The legitimacy comes in the form of Alpari’s External Dispute Resolution (EDR) Service. The entities that conduct the EDR are independent and come with the guarantee of a payment of $20,000. The amount is awarded for possible damages the victor of the dispute had received.

Other protective checks are also provided by Alpari. These checks are detailed below:

- Segregation of Funds

Through Segregated Funds, the client’s funds are duly protected from the company’s operating funds. The clients’ fund may only be accessed through a sophisticated process.

- Funds are Protected by SSL Encryption

Simply put, an SSL Encryption safeguards all of the funds of Alpari’s clients.

- Alpari’s Established Affiliations with Banks

While it is not being regulated by a central bank, Alpari has partnered with a number of trusted banks across international territories. These banks are in charge of regulating the traffic of client funds.

Alpari’s Offers and Services

The Assets Accessible Through Alpari

Alpari is an ECN broker. The firm’s flagship offer is Straight Through Processing (STP).

The firm offers ECN Accounts that are assured of its close proximity to what the market offers. The Spreads offered for these accounts are low.

The Foreign Currency Pairs, Spot Metals, and CFDs like Cryptocurrencies, Index, and Commodities are assets open to all Alpari traders.

When taken by face value, these assets may appear to be numerous. This is not the case however as the review team notes that the offers are actually limited. Alpari only makes two metals pairs, oil and natural gas available for trading transactions.

Alpari: A MetaTrader-Only Brokerage

Alpari had partnered with Metaquotes to access its two industry-leading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is speedy with all transaction processes. Traders online praise the platform for its efficiency. Because of this, the MT4 platform had received numerous positive reviews. The review team agrees with a lot of these reviews.

The features that the review team sees highly efficient include one-click trading, technical indicators, charting tools, and Expert Advisors (EAs) meant for automated algorithmic trading. MT4 also deals with advanced order types.

MetaTrader 5

While not as popular as its predecessor, the MT5 platform lays a lot of features like flexible lot sizing, a selection of funding and withdrawal options, tight spreads, market depth, and the like.

Leverage Provided Through Alpari

1,000:1 is the maximum leverage offered for trades administered with Alpari. The limits vary in accordance to the assets that the client had chosen to trade and the client’s opened live account. The maximum leverages provided for the assets the firm trades are detailed in the table below:

| Asset | Leverage |

| Commodity CFDs | 33:1 |

| Crypto | 2:1 |

| Foreign Exchange Currency Pairs | 1,000:1 |

| Index CFDs | 50:1 |

| Spot Metals | 500:1 |

It is to the opinion of the review team that while the Leverage levels offered by the Alpari appear reasonable at first glance, but upon examination, these are actually beneath the standards of crypto trading.

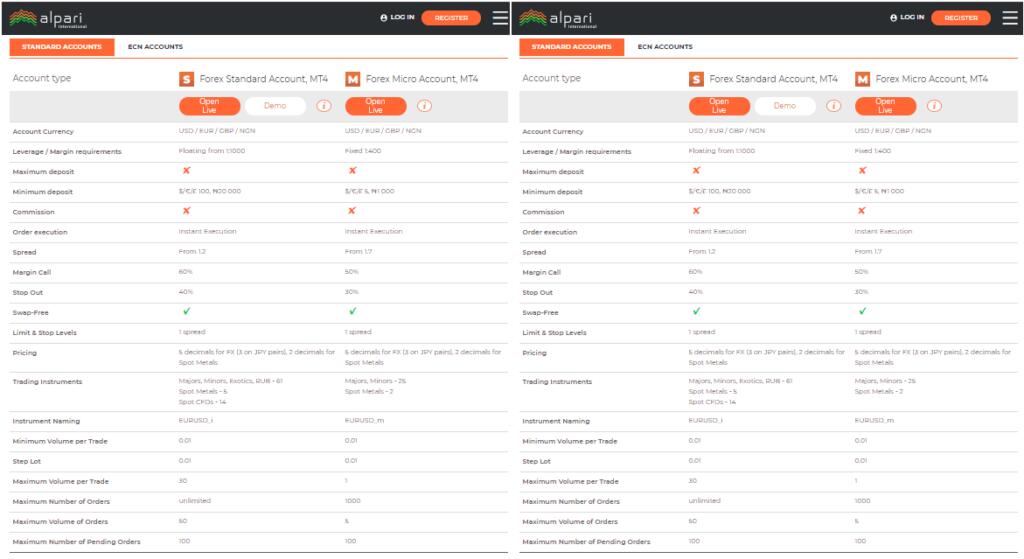

Alpari’s Live Accounts

Despite the preliminary findings discussed here, the review team is sold to Alpari’s services iwith its range of account offerings. These are primarily ECN accounts; these are detailed below:

Trading With Alpari

The offers made by Alpari, while indeed polarizing do have good things to put on the table. The offerings for each account type range from decent to actually good. The firm’s partnership with MetaQuotes is also a plus as it renders all trades with Alpari efficient.

However, the matter stands that the firm’s regulatory status had been found wanting. This is something that the firm should do well addressing.