Increase Your Profit with EMA Forex Trading Strategy and Forex Trends

EMA in Forex Trading

The exponential moving average or simply EMA is a result of a simple moving average or SMA. The EMA is a measuring meter provided on most charting offers. It allows traders to determine trends as well as possible entry and exit signals. Traders have many choices regarding strategy when it comes to trending markets. This article will focus on 50 EMA and how it can be used to create a complete strategy for Forex trends.

50 EMA Forex Trading Strategy

This strategy can be used during Forex trends. You can also try using other EMAs like 10, 20, and 30. Regardless of the number, the trading rules will always be the same. It can be easily applied, and it is compatible with any currency pairs. It also works in any time frame.

Rules for Buying

- Anticipate for the price to break above the 50 EMA.

- The entry candlestick is called when it breaks the 50 EMA.

- A buy stop order 2 to 5 pips should be placed above the high of the candlestick.

- A stop-loss 5 to 10 pips should be placed below the low of the candlestick.

Rules for Selling

- Anticipate for the price to break below the 50 EMA.

- The entry candlestick is called when it breaks the 50 EMA.

- A sell stop order 2 to 5 pips should be placed below the low of the candlestick.

- A stop-loss 5 to 10 pips should be placed above the high of the candlestick.

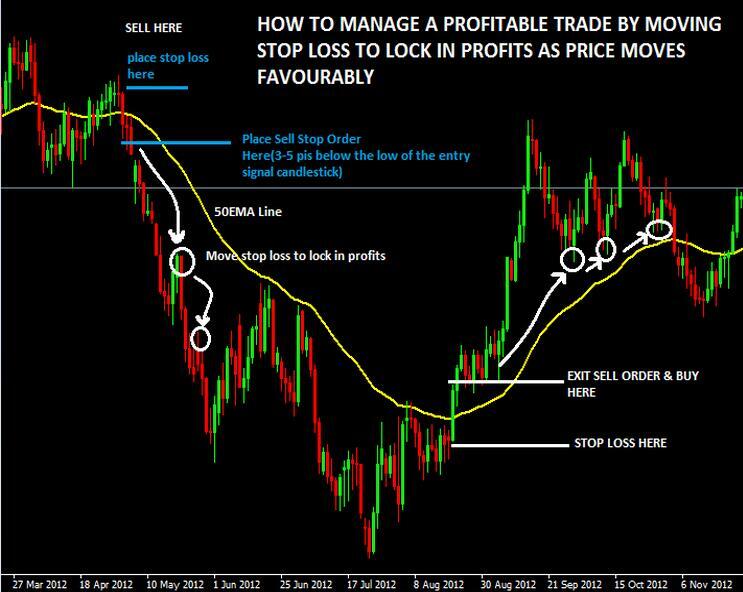

Managing and Exiting a Trade

- When price moves by the amount you risked, you should run the stop loss to breakeven. This tends to get quickly stop out with a loss.

- Anticipating until the price swings and using this to move stop loss is a wise choice. When the price moves, it will undoubtedly help you to lock in more profits.

Pros and Cons of 50 EMA Forex Trading Strategy

- This strategy is very understandable and easy to implement.

- It will not work so well in a non-trending market, and eventually, you will have a lot of false signals.

- There is a significant potential that can be seen in the good trending Forex market by using this 50 EMA trading strategy. It can give you hundreds of pips if taken in extended timeframes.

- There’s this lagging indicator which is called moving average. It means the price moves ahead and the EMA measure meter moves far behind.