The Outside Bar Forex Trading Strategy

The Outside Bar Forex Trading Strategy is a simple trading strategy in that spotting the pattern setup is easy and has uncomplicated trading rules.

The concept of the Outside Bar Forex trading strategy is not any different from that of the Inside Bar Forex trading strategy. Only the pattern setup is different if not directly opposite.

The time frame for this kind of strategy is 4 hours daily

Any of the known Currency Pairs may be observed, and no Forex Indicators are present.

The Outside Bar Pattern

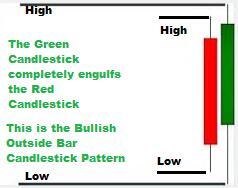

You know how an Outside Bar Pattern looks like takes precedence before you can trade through this Forex strategy. The outside bar is a two-bar (or candlestick) pattern.

The Outside Bar or candlestick overshadows the bar before it.

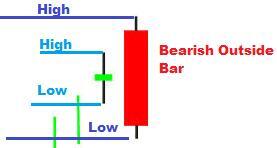

This means the Outside Bar’s high and low engulf the bar that precedes it. The Outside Bar can also be referred to as a “Bullish Engulfing” or “Bearish Engulfing” candlestick pattern.

Below is an example of a Bullish Outside Bar Pattern:

On the other hand, this is what a Bearish Outside Bar Pattern looks like:

The Rules of Outside Bar Forex Trading Strategy

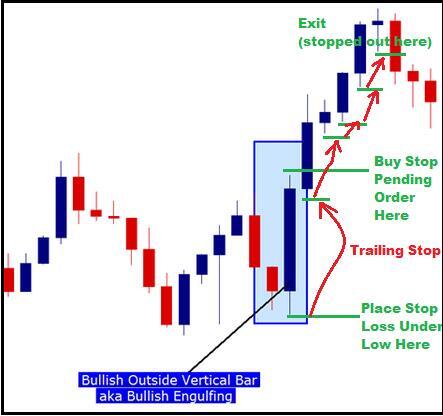

The chart below gives an idea of how to go about trading through the Outside Bar Forex Trading Strategy:

- It is recommendable to place a Buy Stop Order for a Bullish Outside Bar if it is 2-5 pips above the high. On the other hand, it is desirable to place a Sell Stop Order for a Bearish Outside if it is 2-5 pips below the low.

- Then similarly place Stop Loss on the other side; 2-5 pips away from the low if it’s a Buy Stop order and 2-5 pips above the high if it’s a Sell Stop order.

- For your Take Profit target, you are given a few options: you can target previous Swing High points for a Buy Order or last Swing Low points for a sell order. You can also opt for three times your risk. For instance, if you risk 50 pips initially, you should set your Take Profit target at a price level that will give you a 150 pips profit if hit, thus three times your risk.

- Trade Management: Use Trail Stop behind the low if it’s a Buy Order and above the high for a Sell Order. When a candlestick knocks out the low of the previous candlestick for a Buy Order, you will get stopped out. You will also get stopped out when the high of the previous candlestick is intersected for a Sell Order. The takeaway is that you will still be able to get the profit that you’ve earned.

The chart below shows the trade setup for a Buy Order. It will be the exact opposite of a sell setup.

Outside Bar Forex Trading Strategy Advantages

- It is a simple, Forex price action trading system that is easy to comprehend and implement.

- The Outside Bar would be easy to spot if such is your focus; the trading rules would be easy to understand and follow.

- The market has the potential to move a long way once these Outside Bars form. This can deliver hundreds of pips if you ride out the trend and lock your profits through trailing stops placed under Swing High or Lows as price moves in your favor.

Outside Bar Forex Trading Strategy Disadvantages

- Through this, Stop Loss distances are enormous (it follows suit as the more significant the time frames used, the larger the Stop Loss). This means you need to calculate lot sizes following the risk you are willing to take.

- For a fact, there will be times that it may take a while before you can start seeing profits on your trades. This is because the outside bar has already moved a great deal. The next 2-3 candlesticks may not move much distance as opposed to what the Outside Bar did.

- Prohibit yourself from trading Outside bar on areas of the chart that have no significance. You should take trades on Outside Bar when the chart pattern occurs around Support or Resistance levels, Fibonacci levels, Pivots, etc.